Maximize the Value of Your Business Before You Sell

We help mid-market business owners identify hidden value, resolve key risks, and prepare for a confident exit.

We Fix the Risks that Quietly Hurt Valuations

If you’ve built something great, it’s easy to assume buyers will see what you see. But most deals fall short because a few hidden issues make investors hesitate. We will help you find and fix them, before they cost you value.

Inconsistent Financial Reporting

Inconsistent financial reporting and KPIs erode investor confidence because they signal poor operational control and unreliable performance data.

Investors rely on consistent, transparent metrics to assess risk, forecast returns, and validate valuations—without them, a business appears unpredictable and harder to price accurately leader to lower valuation or passing altogether.

Over‑Reliance on You

If the business runs through you, buyers worry it can’t run without you. That’s not a knock — it’s proof you’ve carried a lot.

Our team will help you build systems and leadership depth that make the business transferable — and more valuable by showing a lower personal dependency and greater scalability.

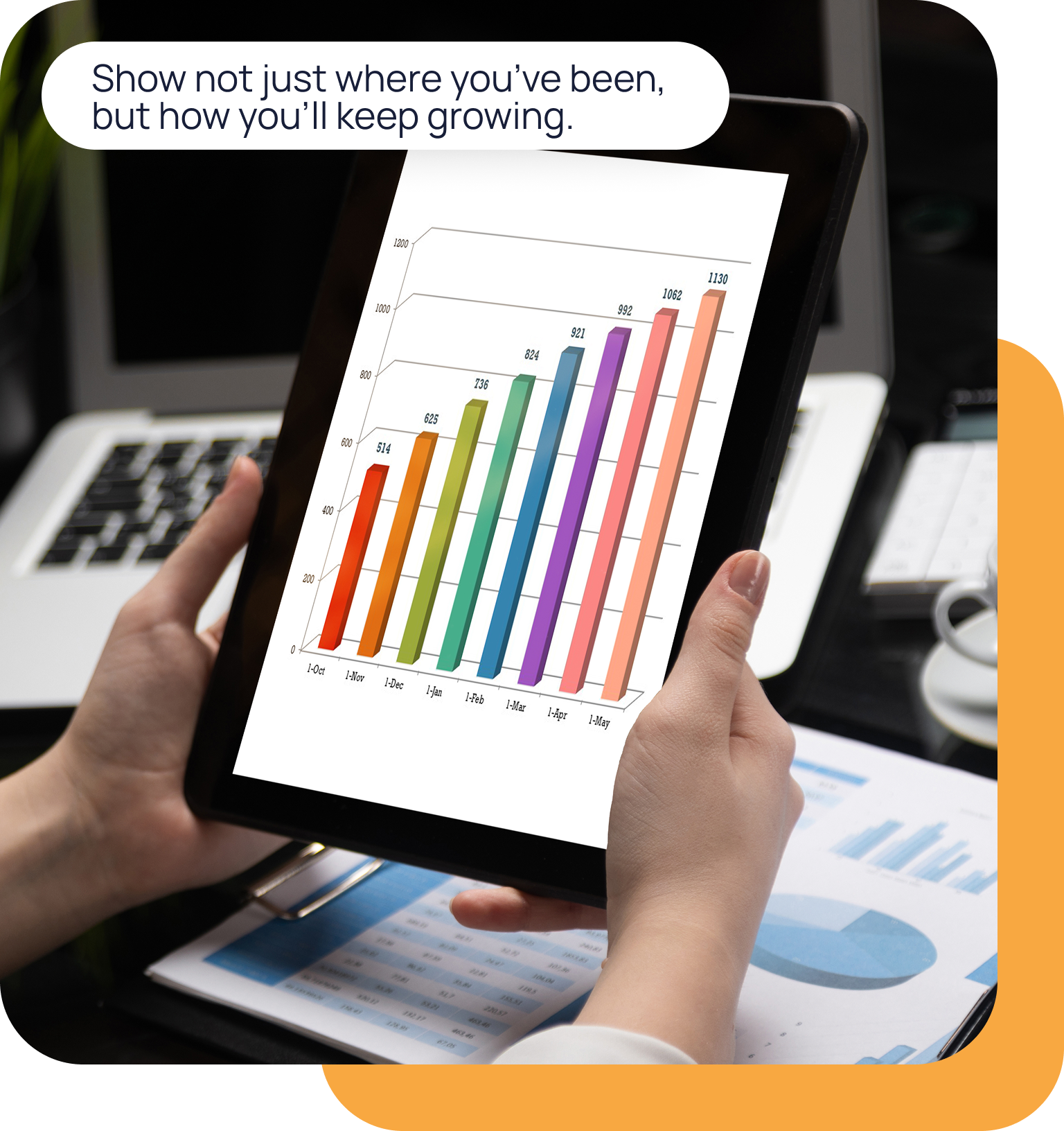

Unclear Growth Story

If you can’t show how you grow profitably, investors can’t model future returns. Remember they are not buying history, they are buying future growth. Without clear unit economics you could be obscuring how the business profitably grows.

We will model your growth engine and link to the performance metrics that prove long-term value.

Concentration Risks

Operational risks like one client making up too much revenue or a supplier holding too much leverage can make a buyer nervous - even if the company is healthy.

Our team can identify and map out these vulnerabilities and strengthen what is working before diligence starts.

Many owners miss out on millions by thinking the sale of their business is just about the financials.

The reality is the preparation to tell a compelling growth story for your business could make the different between 4x and 6-10x.

Our team is comprised of entrepreneurs, former operators, analysts, and domain experts who have guided ventures from early-stage to enterprise scale, executed strategic M&A, and helping companies through all the variations of exit.

We approach every engagement with curiosity, a rigorous methodology, and a commitment to help you grow EBITDA, de-risk operations and expand your exit multiple to reward you for the years of dedicated work.

Real stories from business owners

EAG to helps us optimize critical KPIs and improve GTM. In 12 months, they were able to help us increase enterprise value by 100%. This lead to the successful sale to Insight Software.

Doubled Win Rate

2X Valuation Increase

Publicly traded manufacturing firm needed help to accelerate growth and increase revenue per customer. In two quarters EAG doubled our revenue.

Average deal value went up 35%

181% Increase of revenue per customer

Trusted by entrepreneurs who drive real value

Hands-on Solutions Built for Rapid Growth

Benchmark Analysis & Baseline Valuation

Current‑state diligence across financials, operations, and GTM to identify sale‑readiness gaps and quantify valuation baselines.

➤ Deliverables:

Baseline EBITDA & valuation range, buyer‑risk map, and prioritized action plan (90‑day & 6‑month sprints)

KPI dashboard blueprint and data/controls checklist

➤ Investment: $25-40K

Operational Growth Retainer

Hands‑on support (virtual/on‑site) across GTM functions—pipeline, pricing, packaging, retention, and strategic partnerships. Interim leadership available as part of scope.

➤ Deliverables:

GTM experiments roadmap, enablement, and weekly execution stand-ups

Hands-on support in marketing, biz dev, sales, customer success & strategy

Pipeline metrics dashboards and reporting tuned for buyer narratives

➤ Investment: Start at $25K/mo (individually scoped per client)

Exit Readiness Retainer

Monthly operating cadence review to hold the plan on track: financial review, risk remediation, KPI governance, and board‑style reporting.

➤ Deliverables:

Monthly operator report (EBITDA bridge, risks, wins, next‑step commitments)

Owner dependency reduction plan; governance and role clarity

➤ Investment: $5-25K/mo

Sale Preparation & Deal Support

Buy‑side appeal packaging and introductions; support through diligence to close. Fee: 5% of transaction value or 10% of valuation uplift from the established baseline (select structure at engagement).

➤ Deliverables:

Confidential Information Memo (CIM) / buyer deck, data room readiness, diligence Q&A, business KPIs, & GTM metrics

Coordination with legal/tax; negotiation support alongside your banker or ours

➤ Investment: Start at 1% of sales transaction (individually scoped per client)

Who We Help

$2-10M in ebitda/eboc is our minimum threshold. This generally correlates to a revenue range between $7-50M.

EBITDA/EBOC

Ideally we are looking for non owner management where a GM/VP runs the day to day. If this is not the case today but you have a promotable manager in place we can work with that.

Non-Owner Management

We only work with single owners or two person partnerships, ideally where the owner(s) are non-operating.

Closely Held Ownership

Our firm is focused on South Florida based businesses as our team is local and it enables us to engage more effectively.

South Florida Based

Business Owner FAQs

-

Within the first 30 days we can complete the Business Analysis and baseline valuation to provide a foundational understanding of where the business is from a buyer’s lens. For operational retainers, you will see results within 90 days as we focus on improvements that buyers notice (finance hygiene, owner‑dependency, KPI discipline) while initiating GTM tests to accelerate growth.

-

There is never any pressure to sell the business from the EAG team. Our goal is to make your business grow faster and generate more EBITDA. It is completely up to you when and if you decide to sell. We appreciate there are many factors that come into play around the timing of a sale and we leave that up to ownership.

-

Our team can play a variety of roles ranging from executive advisors, to management coach to actual day-to-day execution or a combination of these. We can operate as interim roles across marketing, business development, sales and customer success as needed. We will scope your engagement based on your business org structure and key needs.

-

The EAG team works as a strong compliment to a business broker, but not a replacement. We focus on helping your business improve its operations, financial cleanliness, and GTM metrics. Our goal is to create the most compelling business growth story that empower you as the owner to demand the highest multiple possible.

-

No, similar to business brokers we compliment your financial and legal advisors to make the business more attractive and diligence ready.

-

Our team is composed of domain experts in all the areas we focus on. We have worked with over 170 companies over the last 10 years, many of which are household names you know and some of which are the fastest growing companies in the country. We bring all this experience and expertise to bear on your business.

Let’s Get Introduced

Ready to see your valuation through an investor’s eyes?

Get your confidential, no-obligation valuation benchmark today!